Canadian Seasonal Expense Patterns

Seasonal costs can consume 40-60% of annual discretionary spending if unmanaged, making proactive planning essential for Canadian families.

Read Guide →

Winter Budgeting (October-March)

Monthly heating budget $150-400 depending on home size, program thermostat for 10-15% savings, weather stripping investments, emergency heating fund planning.

Read Guide →

Winter Clothing and Equipment

Annual winter wardrobe budget $200-500 per adult, children's winter gear $100-300 per child, seasonal gear investment, pre-season shopping for best prices.

Read Guide →

Back-to-School Season (August-September)

Educational expenses per child: School supplies $100-250, clothing $150-400, technology $200-800, extracurricular fees $200-800, total per child $650-2,250.

Read Guide →

Strategic Back-to-School Planning

Summer sales shopping (July-August), hand-me-down and resale market utilization, generic brand school supplies, technology planning for multi-year use.

Read Guide →

Holiday Season (November-December)

Comprehensive holiday budgeting: Gift budget 1.5% of annual income per recipient tier, food and entertaining 0.5-1% of annual income, travel costs variable, decorations $100-300 total.

Read Guide →

Holiday Budget Management

Start saving in October (monthly sinking fund), set per-person gift limits, DIY gift options for cost savings, alternative celebration strategies, post-holiday debt prevention.

Read Guide →

Seasonal Planning Tips

Start saving for seasonal expenses 3 months early, track actual spending to improve estimates, use storage containers to organize items, consider sharing costs with extended family.

Read Guide →Canadian Seasonal Expense Patterns

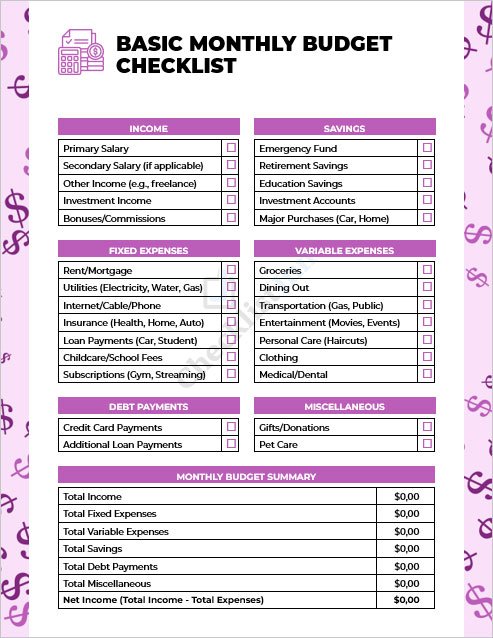

Seasonal costs can consume 40-60% of annual discretionary spending if unmanaged, making proactive planning essential for Canadian families. Understanding these patterns allows for better budget preparation and stress reduction.

Why Seasonal Planning Matters in Canada

- Harsh winters require higher heating costs

- Variable weather affects transportation and clothing needs

- Back-to-school represents major annual expense

- Holiday season creates concentrated spending periods

- Seasonal employment affects income patterns

Winter Budgeting (October-March)

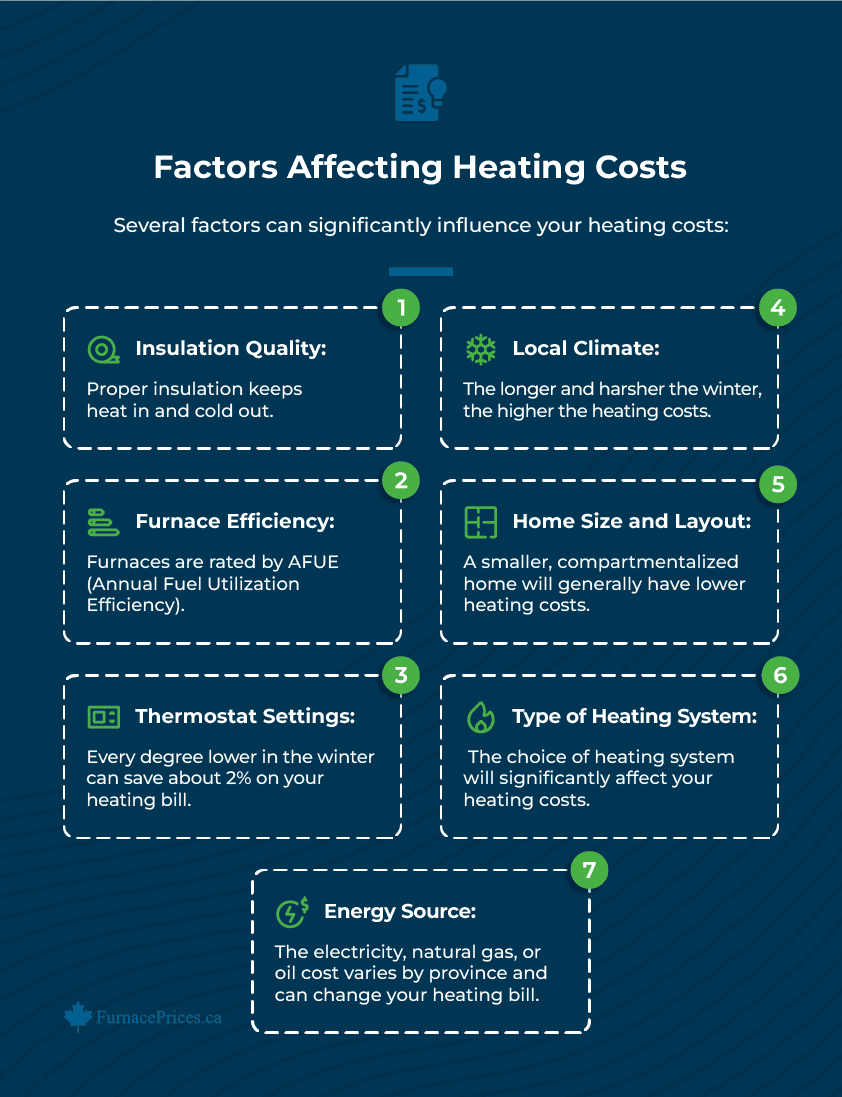

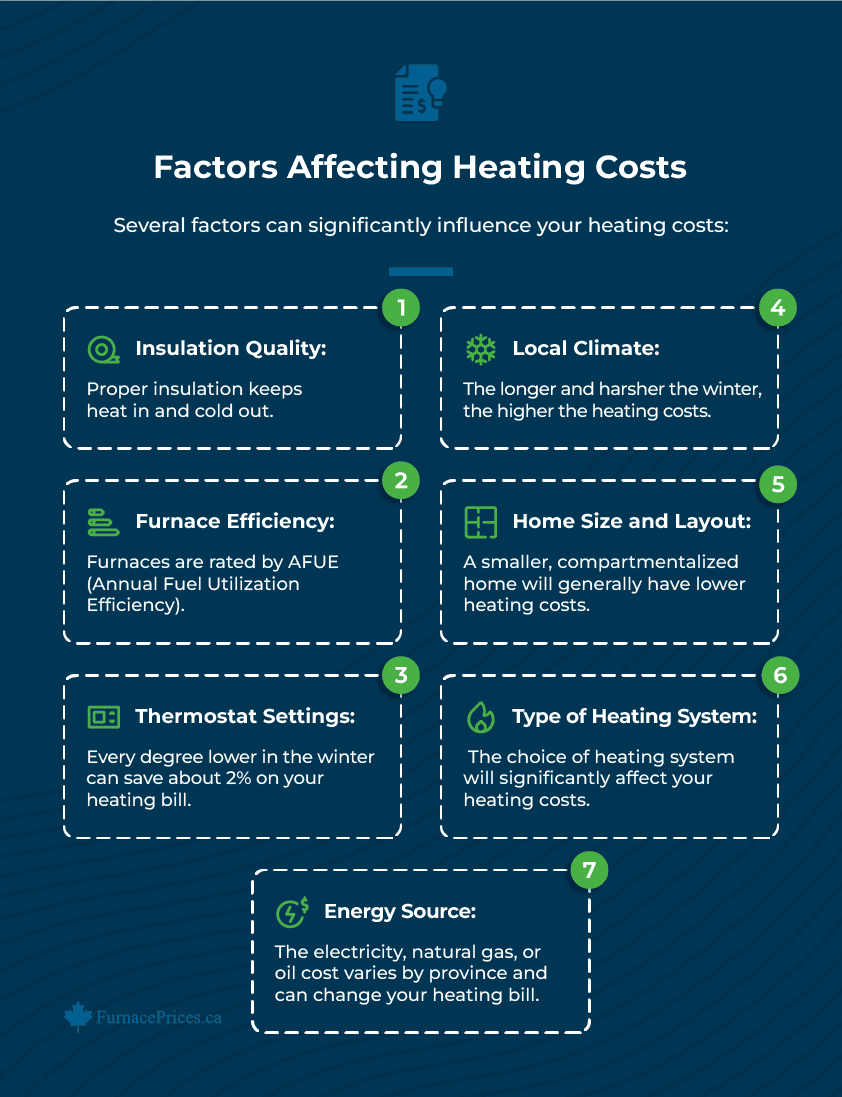

Heating Cost Management

- Monthly heating budget: $150-400 depending on home size

- Program thermostat to reduce costs by 10-15%

- Weather stripping and insulation investments

- Alternative heating sources for efficiency

- Emergency heating fund for unexpected repairs

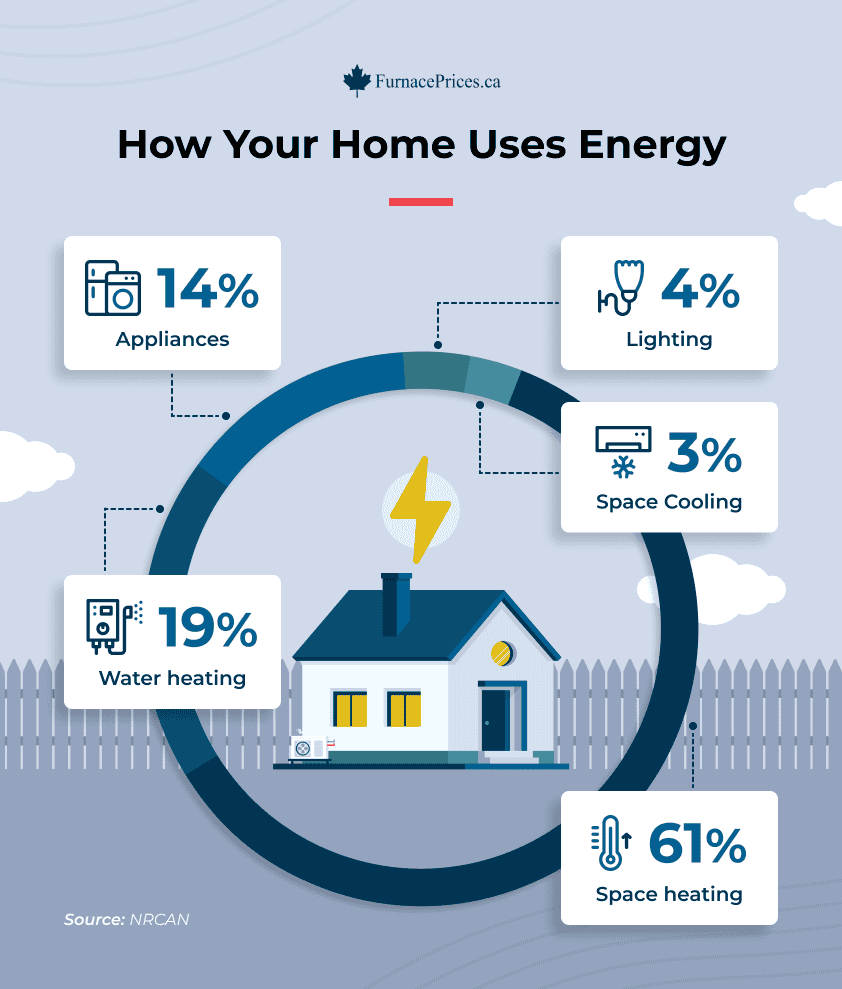

Winter Energy Cost Breakdown

- Space heating: 61% of home energy consumption

- Water heating: 19% of energy usage

- Appliances: 14% of energy consumption

- Lighting: 4% of energy use

- Space cooling: 3% (minimal in winter)

Heating Cost Reduction Tips

- Seal drafts around windows and doors

- Use smart thermostats for better control

- Perform regular HVAC maintenance

- Install energy-efficient windows

- Utilize ceiling fans for better air circulation

- Heat only used rooms

Back-to-School Season (August-September)

Educational Expenses per Child

- School supplies: $100-250

- Clothing and footwear: $150-400

- Technology (if needed): $200-800

- Extracurricular fees: $200-800

- Total per child: $650-2,250

Cost-Saving Strategies

- Shop summer sales (July-August) for best prices

- Use hand-me-downs and family clothing swaps

- Shop at discount stores for basic supplies

- Buy technology with multi-year lifespan in mind

- Ask schools for required supply lists early

Monthly Sinking Fund Calculation

- Start saving in May for September expenses

- Total annual budget ÷ 5 months = monthly savings

- Open separate savings account for tracking

- Automate transfers to maintain consistency

Holiday Season (November-December)

Comprehensive Holiday Budgeting

- Gift budget: 1.5% of annual income per recipient tier

- Food and entertaining: 0.5-1% of annual income

- Travel costs: Variable based on family choices

- Decorations and extras: $100-300 total

Gift Budget Tiers

- Immediate family: $100-200 per person

- Extended family: $50-100 per person

- Close friends: $25-50 per person

- Colleagues/neighbors: $15-25 per person

Holiday Savings Strategy

- Start saving in October using sinking fund method

- Set per-person gift limits and stick to them

- Consider DIY gifts and experiences over items

- Use cashback credit cards for holiday purchases

- Plan for post-holiday debt repayment in January

Seasonal Planning Tips

- Start saving for seasonal expenses 3 months early

- Track actual spending to improve future estimates

- Use storage containers to organize seasonal items

- Consider sharing costs with extended family

- Plan for inflation in annual expense estimates

- Create separate savings accounts for major seasons

- Review and adjust fund amounts annually

The Sinking Fund System

Create separate savings accounts for each major seasonal category:

- Annual Home Maintenance Fund: 1% of home value

- Holiday and Gift Fund: $1,200/year or $100/month

- Back-to-School Fund: $800-1,200 per child annually

- Winter Heating Fund: $100-200 extra monthly Oct-Mar