Complete Emergency Fund Strategy

Building financial security through Canada's unique liquidity system. Statistics show roughly one in four Canadian households cannot handle a $500 emergency without borrowing.

Read Guide →

The Canadian Three-Tier Emergency Fund System

Tier 1: Stability Fund (core emergency reserve), Tier 2: Opportunity Fund (strategic liquidity), Tier 3: Wealth Reservoir (advanced strategy for $100K+ net worth).

Read Guide →

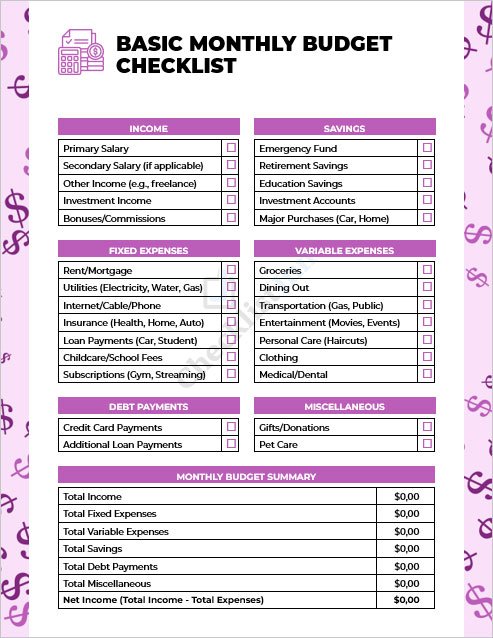

Monthly Emergency Fund Contribution Schedule

Start small but consistent: Month 1-3: $200/month → $600, Month 4-12: $300/month → $3,600, Year 2: $400/month → $4,800 total.

Read Guide →

Canadian Savings Account Hierarchy

Emergency Fund (3-6 months expenses) in HISA or TFSA, Short-term Goals (1-3 years) in TFSA savings, Medium-term (3-10 years) in TFSA investments, Long-term (10+ years) in RRSP or TFSA.

Read Guide →

TFSA vs RRSP Strategy for Families

TFSA: Tax-free growth, no impact on benefits, flexibility. RRSP: Immediate tax deduction, higher income households benefit most, employer matching programs, income splitting opportunities.

Read Guide →

Family Savings Automation

Monthly transfers: Emergency fund 5-10% of net income, TFSA contribution $500-1,000 monthly, RESP contribution $125-250 per child, major purchase fund 2-5% of income.

Read Guide →

Savings Acceleration Strategies

Windfall allocation (tax refunds, bonuses, gifts), automatic escalation (increase savings rate annually), investment income reinvestment, side hustle income allocation.

Read Guide →

Savings Tips

Pay yourself first (savings before discretionary spending), use windfalls strategically, increase savings rate annually, separate emergency fund from other savings, review investment allocations regularly.

Read Guide →Complete Emergency Fund Strategy

Statistics show roughly one in four Canadian households cannot handle a $500 emergency without borrowing, and more than half would struggle with an expense over $1,000. Rising costs, inflation, and competing priorities like mortgages make emergency preparedness essential for Canadian families.

Why Canadians Need Emergency Funds

- Housing affordability challenges

- Rising cost of living pressures

- Variable income from seasonal employment

- Healthcare cost exposure

- Economic uncertainty and job market volatility

The Canadian Three-Tier Emergency Fund System

Tier 1: The Stability Fund (Core Emergency Reserve)

- Purpose: Protect against immediate financial shocks

- Recommended Amount: Minimum $1,000, one month of expenses, final target three months

- Where to Keep It: High-Interest Savings Account (HISA) or TFSA

- Key Benefits: Instant access, peace of mind, avoids debt during emergencies

Tier 2: The Opportunity Fund (Strategic Liquidity)

- When to Build: After achieving 3 months of expenses in Tier 1

- Structure: 1-2 months expenses in cash + zero-balance personal Line of Credit

- Benefits: Capital can work harder while maintaining safety net

- Strategy: Use LOC as safety valve, not primary fund

Tier 3: The Wealth Reservoir (Advanced Strategy)

- When to Consider: For mid-to-high net worth households ($100K+ net worth)

- Structure: High cash value whole life insurance policy

- Benefits: Tax-sheltered growth, guaranteed returns, accessible through policy loans

- Role: Balances portfolio volatility while providing liquid access

TFSA vs RRSP Strategy for Families

TFSA Priority Factors

- Tax-free growth and withdrawals

- No impact on government benefits

- Flexibility for emergency fund storage

- Can fund major purchases without tax implications

- Contribution room carries forward

RRSP Priority Factors

- Immediate tax deduction

- Higher income households benefit most

- Employer matching programs (free money)

- Principal residence exemption strategy

- Income splitting opportunities in retirement

Recommended Strategy

- Start with TFSA for flexibility and no tax impact

- Prioritize TFSA until maxed out

- Then contribute to RRSP if in higher tax bracket

- Consider employer RRSP matching first (free money)

Savings Tips

- Pay yourself first (savings before discretionary spending)

- Use windfalls strategically (tax refunds, bonuses, gifts)

- Increase savings rate annually with salary growth

- Separate emergency fund from other savings

- Review investment allocations regularly

- Take advantage of employer matching programs

- Automate savings transfers to build consistency