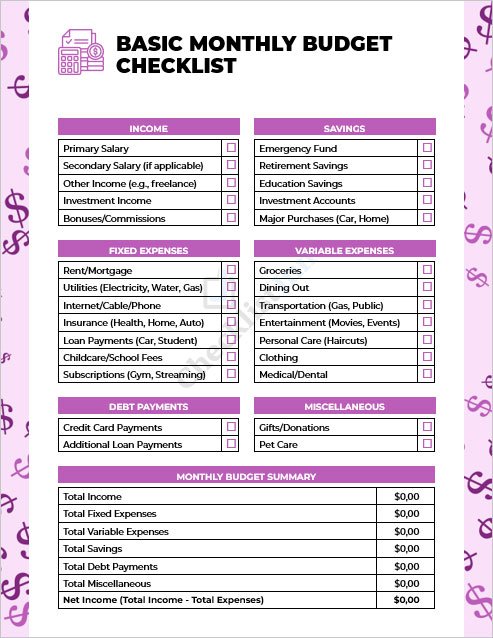

Monthly Budget Review Checklist

Income verification, expense tracking, savings assessment, and budget adjustments checklist with Canadian tax considerations and GST/HST implications.

Download Template →

Emergency Fund Planning Checklist

Initial setup, fund building progress (milestones at $1,000, 1 month, 3 months, 6 months), and ongoing management with Canadian banking options.

Download Template →

Grocery Planning Template

Weekly planning structure, shopping strategy, budget allocation by food category, and Canadian-specific considerations for seasonal produce and GST/HST.

Download Template →

Seasonal Budget Template

Annual planning framework, major seasonal events identification, historical spending analysis, and monthly sinking fund contributions calculator.

Download Template →

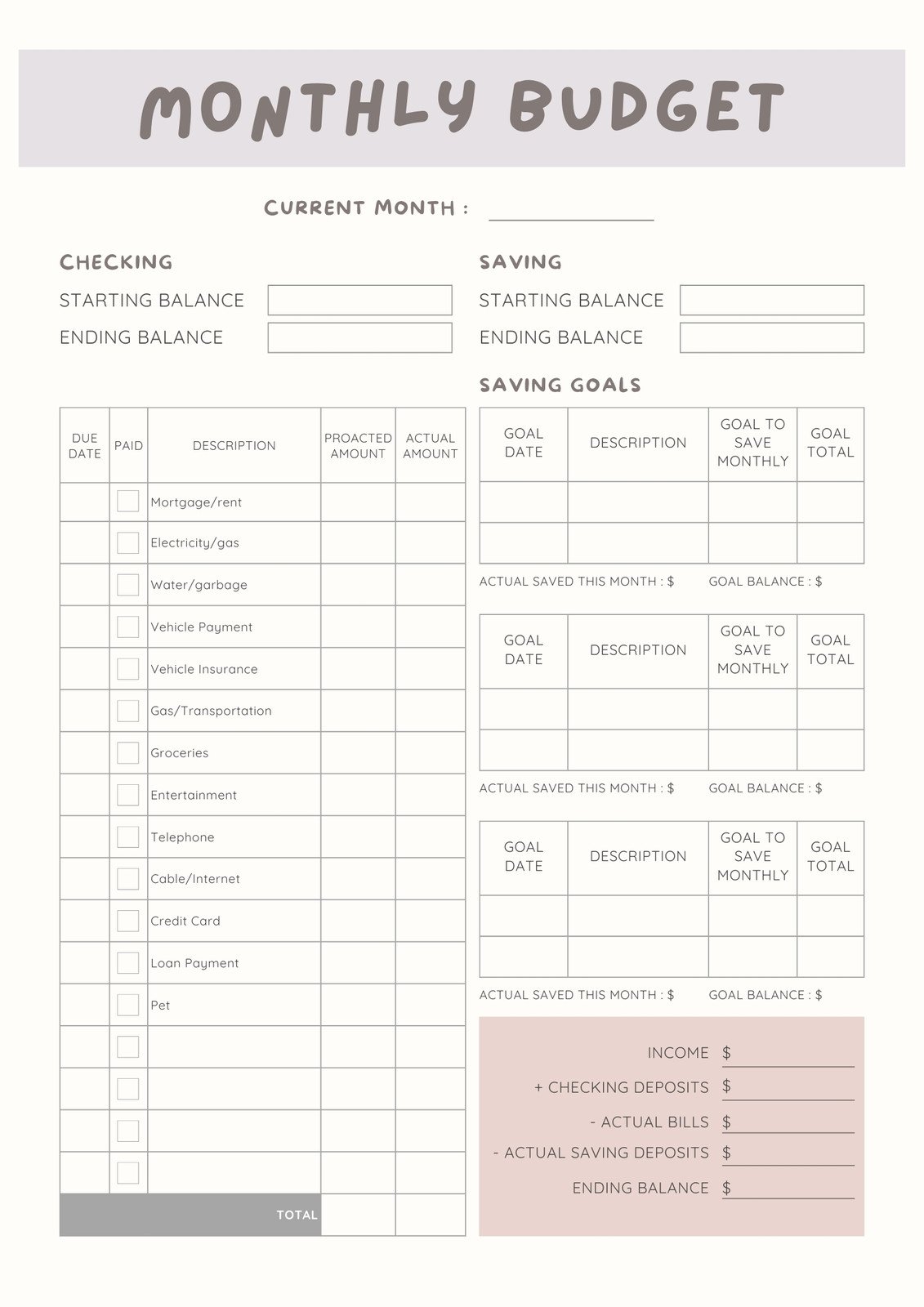

Canadian Budget Template

Comprehensive monthly budget template with Canadian categories, TFSA/RRSP sections, GST/HST considerations, and provincial tax planning.

Emergency Fund Progress Tracker

Track your progress toward 3-6 months of expenses with milestones, monthly contributions, and Canadian high-interest savings account options.

Weekly Grocery Tracker

Plan meals, track spending, and compare actual vs. budgeted grocery costs with Canadian grocery store comparisons and seasonal produce planning.

Financial Planning Checklist

Complete family financial planning checklist including insurance reviews, investment goal setting, and Canadian-specific tax planning strategies.

View Checklist →Monthly Budget Review Checklist

Income Verification

- All income sources accounted for (employment, benefits, investments)

- Tax implications considered for any income changes

- Seasonal variations in income noted

- Government benefits updated (child tax benefit, GST/HST rebate)

Expense Tracking

- All fixed expenses recorded (rent, insurance, utilities)

- Variable expenses tracked (groceries, entertainment, gas)

- Unexpected expenses noted and categorized

- GST/HST implications on purchases considered

Savings Assessment

- Emergency fund contributions on track

- TFSA/RRSP contributions meeting annual targets

- RESP contributions current for children

- Major purchase fund growing appropriately

Budget Adjustments

- Overspending categories addressed

- Underspending categories reallocated

- Next month's budget adjusted based on findings

- Seasonal expenses properly allocated

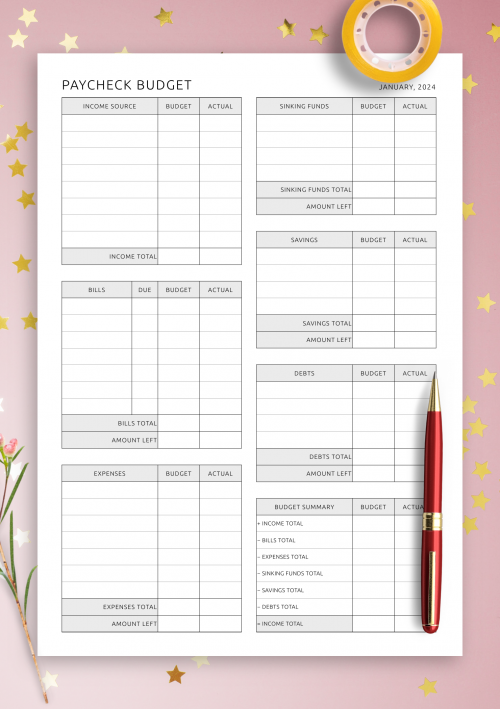

Emergency Fund Planning Checklist

Initial Setup

- Emergency fund target calculated (3-6 months expenses)

- High-interest savings account opened

- Monthly transfer amount determined

- Separate account tracking system created

Fund Building Progress

- $1,000 milestone achieved

- One month expenses saved

- Three months expenses saved (minimum target)

- Six months expenses saved (recommended target)

Ongoing Management

- Monthly transfers automated

- Account earning competitive interest rate

- Regular balance monitoring

- Annual fund adequacy reassessment

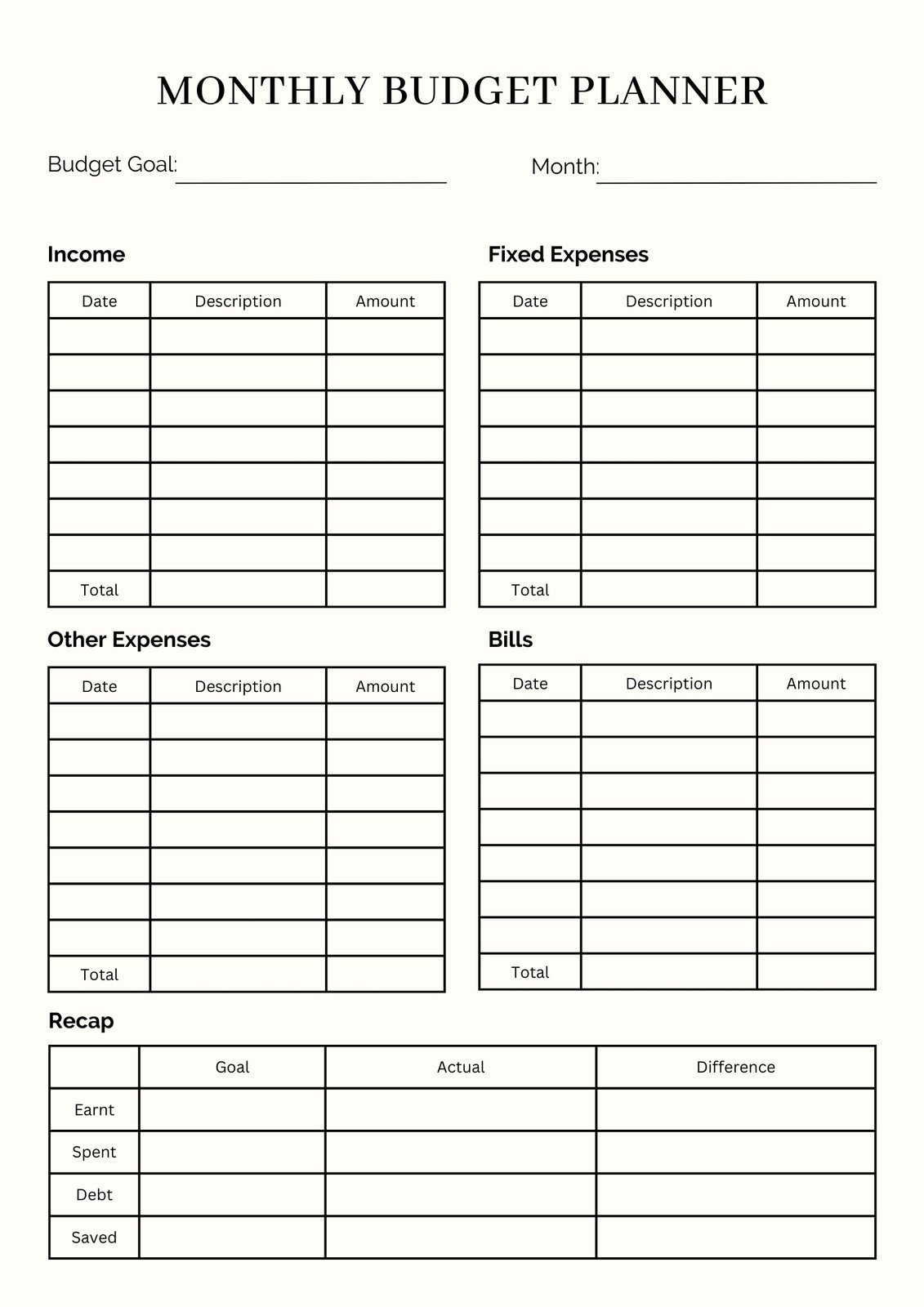

Seasonal Budget Template

Annual Planning Framework

- Major seasonal events identified

- Historical spending patterns analyzed

- Annual budgets set for each season

- Monthly sinking fund contributions calculated

- Expense tracking systems organized

Seasonal Preparation

- Winter: heating, clothing, holiday budgets

- Spring: home maintenance, spring cleaning supplies

- Summer: vacation, activities, camp planning

- Fall: back-to-school, winter preparation, holiday saving

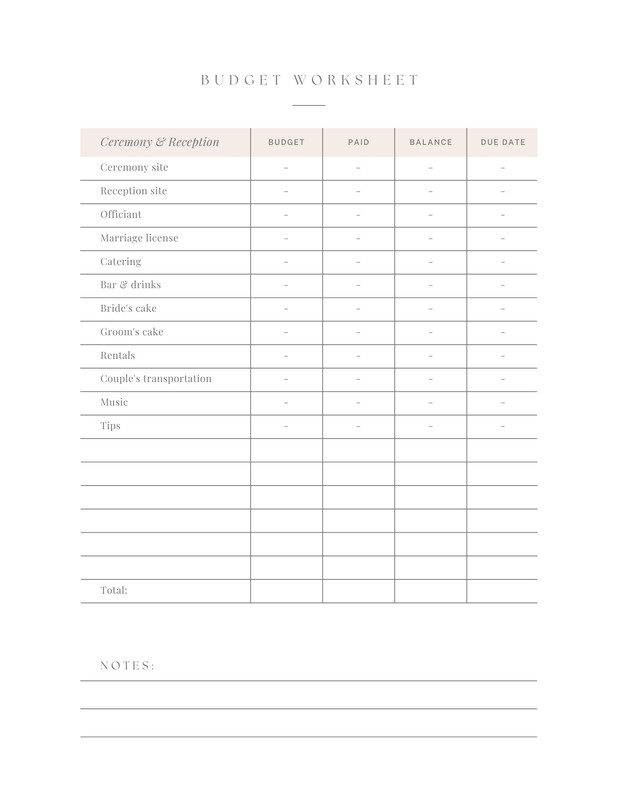

Financial Planning Checklist

Insurance Reviews

- Life insurance coverage adequate (8-10x income)

- Disability insurance in place

- Home/renter's insurance current

- Auto insurance shopped for best rates

Investment Goal Setting

- TFSA contribution room utilized

- RRSP contributions optimized for tax benefit

- Investment portfolio aligned with risk tolerance

- Diversification across asset classes

Canadian Tax Planning

- Child tax benefit optimization

- GST/HST credit considerations

- Provincial tax implications reviewed

- Income splitting strategies evaluated

Download Your Complete Budget Toolkit

Get all templates and checklists in CSV format for easy customization

All templates include Canadian-specific features and GST/HST considerations