Rent Negotiation Strategies

Demonstrate reliability, propose long-term solutions, and conduct cost-benefit analysis to secure better rental terms in competitive Canadian markets.

Read Guide →

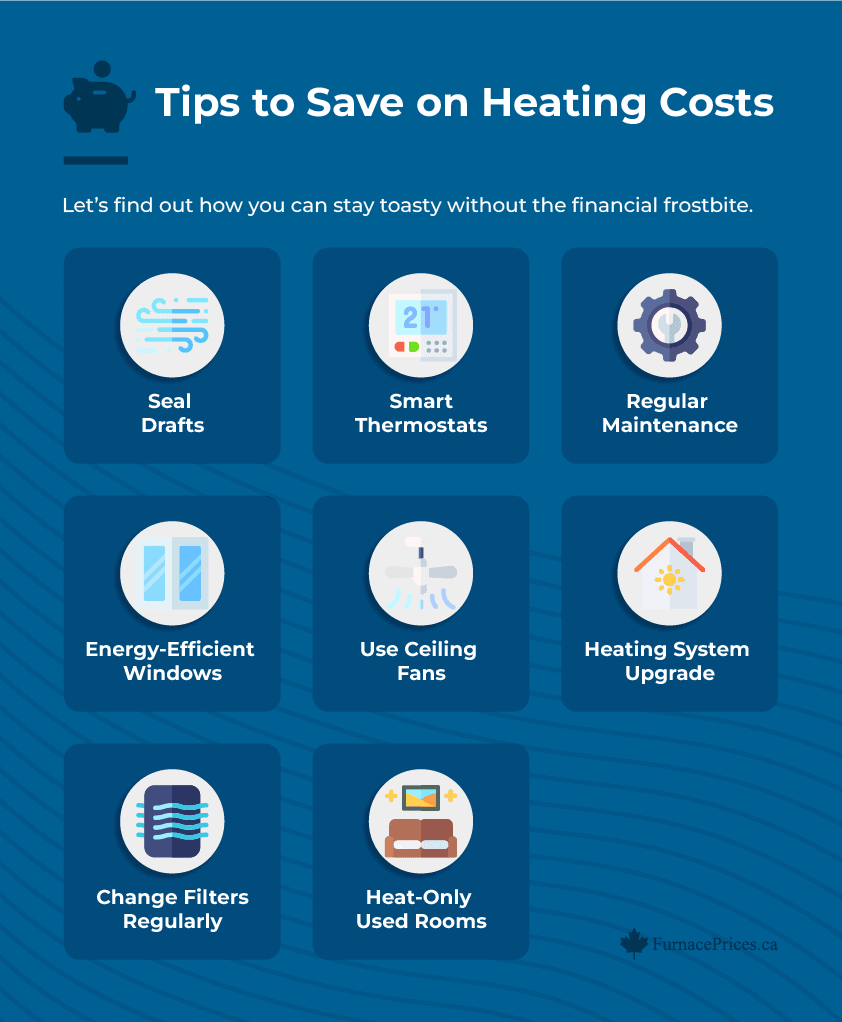

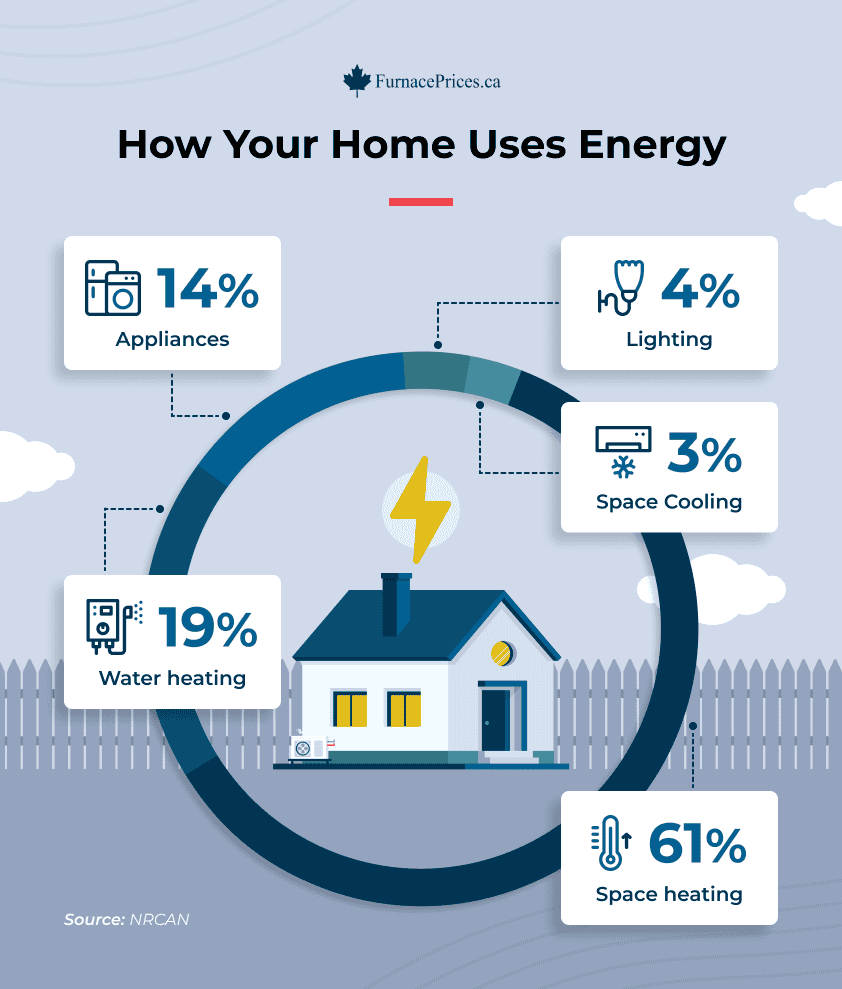

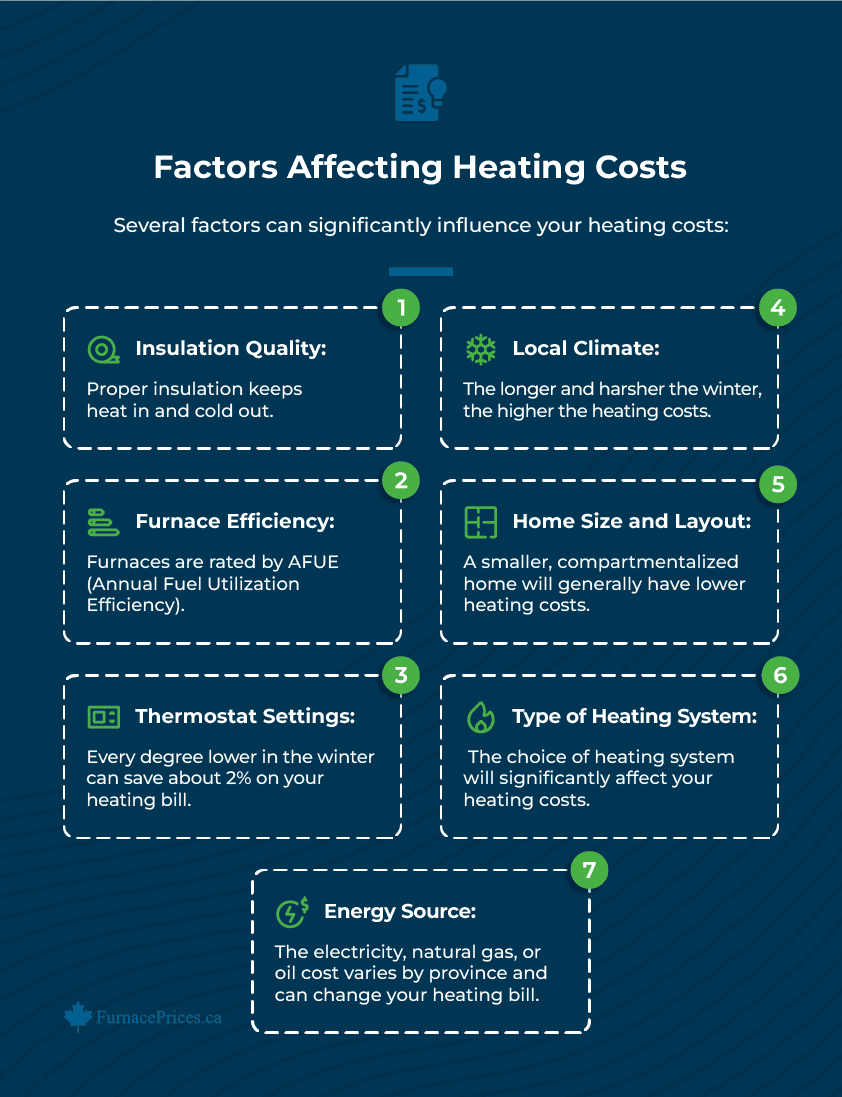

Heating and Cooling (35% of utilities)

Set thermostat to 20°C in winter, use programmable thermostats, seal air leaks, consider zone heating, and maintain HVAC systems annually.

Read Guide →

Water and Sewer (20% of utilities)

Install low-flow fixtures, fix leaks promptly, use cold water for washing, take shorter showers, and optimize water heating settings.

Read Guide →

Internet and Phone (30% of utilities)

Negotiate annual contracts for better rates, bundle services when it saves money, review data plans annually, and consider competitor offers.

Read Guide →

Home/Renter's Insurance Management

Shop around annually for 15-25% savings, increase deductibles, bundle policies, install security systems, and maintain good claims history.

Read Guide →

Life Insurance Priority

Primary earner: 8-10x annual income, Secondary earner: 5-8x annual income, Stay-at-home parent: $100,000-300,000 for childcare replacement value.

Read Guide →

Utilities Optimization (35-45% of income)

Canadian utility costs can consume $400-800 monthly for average families. Strategic management reduces costs without sacrificing comfort.

Read Guide →

Monthly Essentials Tips

Negotiate utilities annually for 10-20% savings, set up automatic bill payments, monitor usage patterns, and review insurance policies annually.

Read Guide →Rent Negotiation Strategies

With Canadian rental markets averaging 30% of net income for many families, strategic approaches to housing costs are essential.

Demonstrate Reliability

- Provide recent pay stubs showing stable income

- Offer references from previous landlords

- Credit score reports

- Employment verification letters

Propose Long-term Solutions

- Suggest 24-month lease terms

- Offer automatic payment setup

- Provide character references

- Negotiate rent freeze in exchange for longer commitment

Cost-Benefit Analysis

- Compare total costs including utilities, parking, internet

- Factor in commute costs to new location

- Consider proximity to schools and amenities

Utilities Optimization

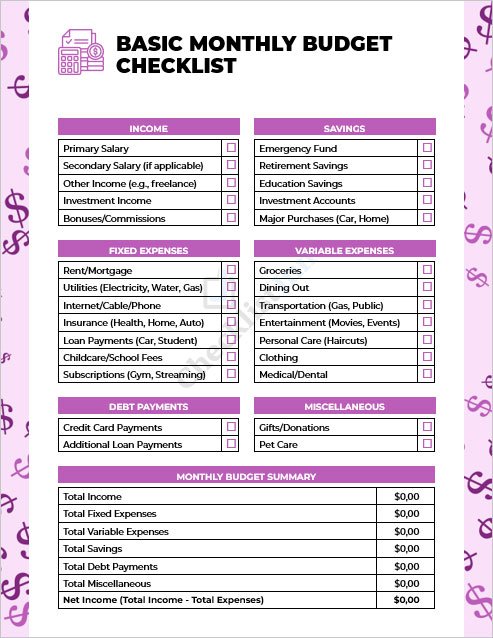

Canadian utility costs can consume $400-800 monthly for average families. Strategic management reduces costs without sacrificing comfort.

Understanding Your Utility Breakdown

- Heating and Cooling: 35% of total utilities

- Water and Sewer: 20% of total utilities

- Internet and Phone: 30% of total utilities

- Electricity: 15% of total utilities

Monthly Essentials Tips

- Negotiate utilities annually for potential 10-20% savings

- Set up automatic bill payments to avoid late fees

- Monitor usage patterns to identify savings opportunities

- Consider energy-efficient appliances for long-term savings

- Review insurance policies annually for better rates

- Bundle services when it provides genuine value

- Track monthly expenses to identify trends