Step 1: Gather Your Financial Reality

Start by collecting 3 months of financial documents including recent pay stubs, bank statements, utility bills, rent payments, insurance statements, and monthly obligations.

Read Guide →

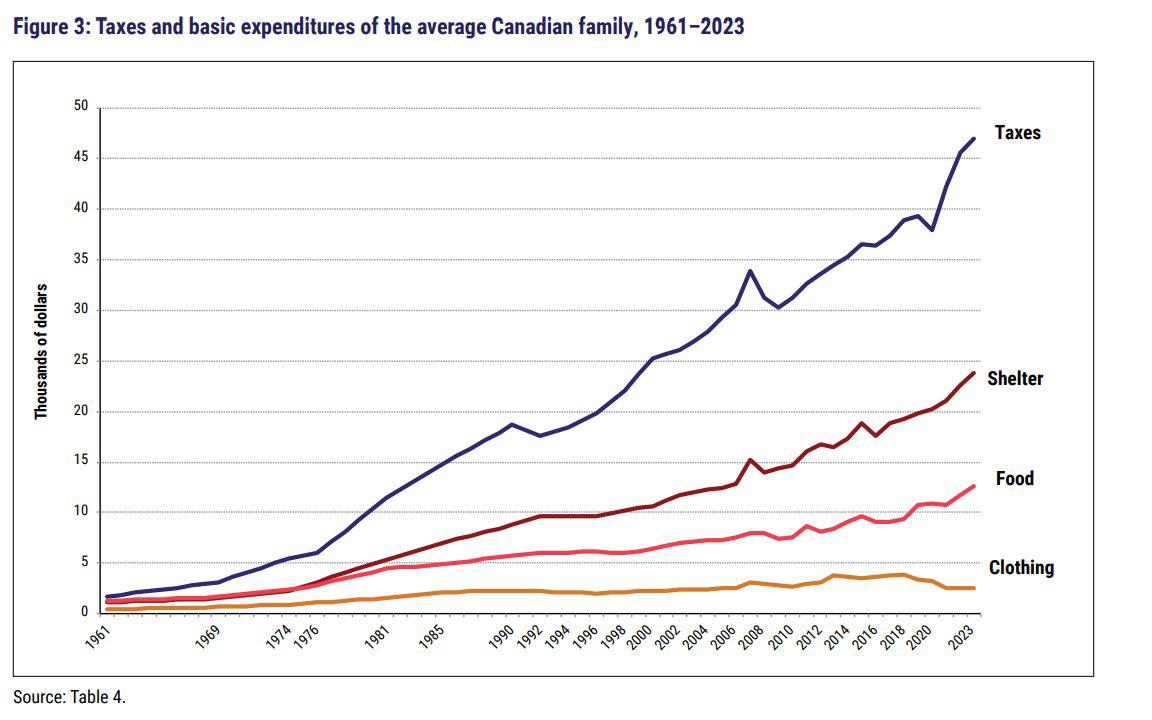

Step 2: Use the 50/30/20 Framework Adapted for Canada

For net monthly income: 50% Needs (housing, utilities, groceries), 30% Wants (entertainment, dining out), 20% Savings (emergency fund, TFSA/RRSP).

Read Guide →

Step 3: Choose Your Canadian Budgeting Method

Compare Zero-Based Budgeting, Envelope System, 50/30/20 Rule, and Buffer Budget approaches to find the best fit for your family.

Read Guide →

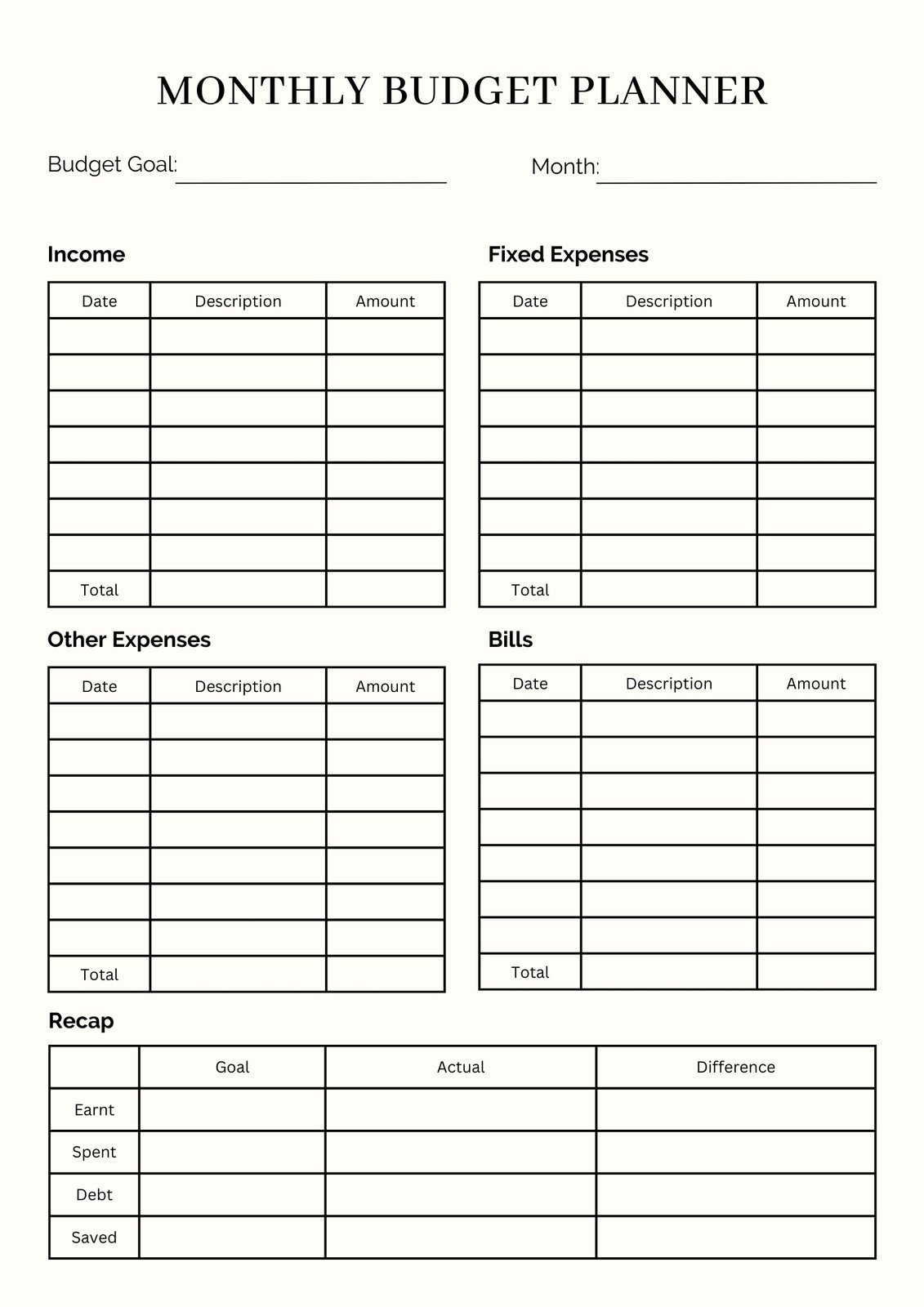

Step 4: Set Up Your Canadian Budgeting Tools

Use FCAC Budget Planner, banking apps with budgeting features (RBC NOMI, TD MySpend, CIBC Smart Planner), and comprehensive tracking tools.

Read Guide →

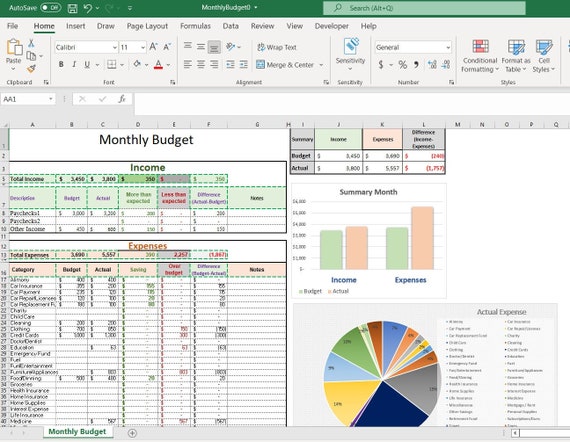

Step 5: Monthly Budget Management Routine

Establish a consistent routine: First of month review, mid-month check-in, end of month reconciliation, and quarterly complete review.

Read Guide →

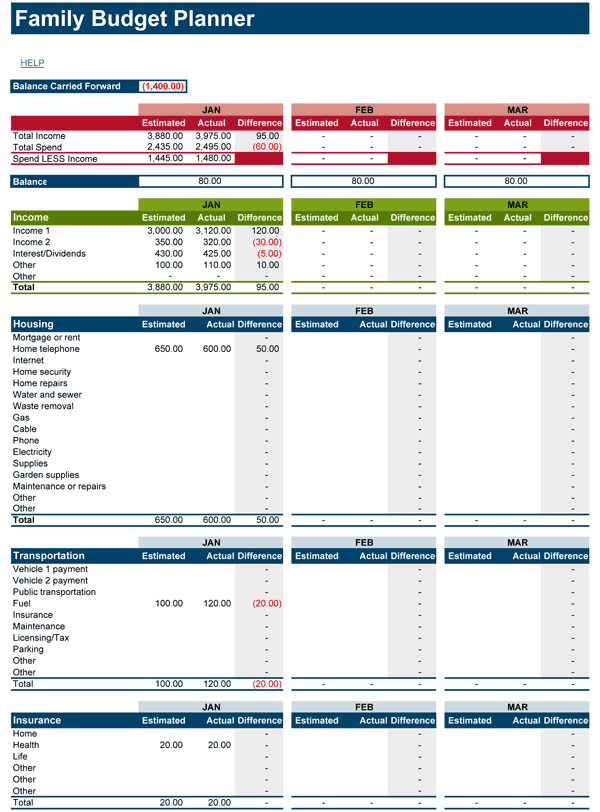

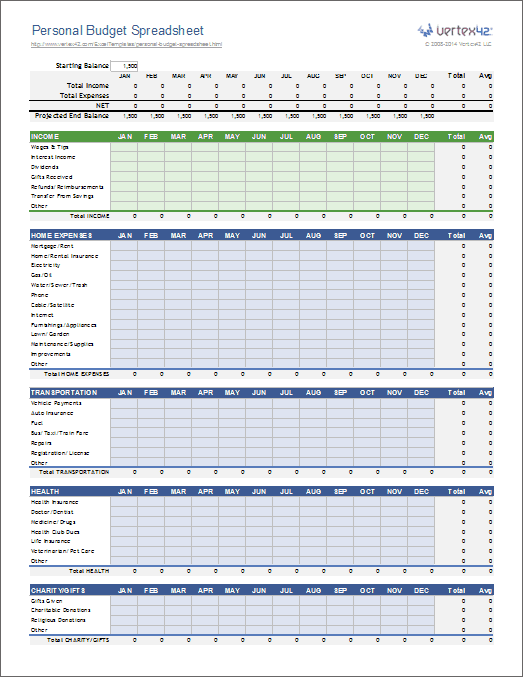

Core Income Categories for Canadian Families

Employment income, investment income (dividends, interest), government benefits (child tax benefit, GST/HST rebate), and business income.

Read Guide →

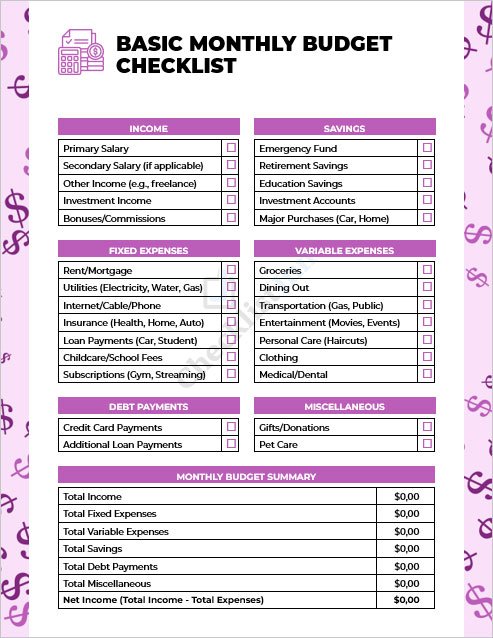

Essential Expense Categories

Housing (35-45%), Transportation (10-15%), Food (10-15%), Insurance (5-10%), and Debt Payments (5-15%) breakdown with Canadian considerations.

Read Guide →

Canadian Budget Setup Tips

Start with 3 months of actual spending, include a "miscellaneous" category (3-5%), use separate accounts for goals, and review quarterly with GST/HST considerations.

Read Guide →Gather Your Financial Reality (Week 1)

Start by collecting 3 months of financial documents to establish your baseline:

- Recent pay stubs from all income sources

- Bank and credit card statements

- Utility bills (natural gas, electricity, water, internet, cell phone)

- Rent/mortgage payment information

- Insurance premium statements

- Any other monthly obligations

This baseline will help you understand where your money actually goes versus where you think it goes.

50/30/20 Framework Adapted for Canada

For net monthly income, this proven framework works well for Canadian families:

- 50% Needs: Housing, utilities, groceries, minimum debt payments, basic insurance

- 30% Wants: Dining out, entertainment, hobbies, travel, non-essential purchases

- 20% Savings: Emergency fund, retirement savings (TFSA/RRSP), debt principal payments

Example for $5,000/month household income:

- Needs ($2,500): Rent ($1,200), groceries ($600), utilities ($250), transportation ($300), insurance ($150)

- Wants ($1,500): Entertainment ($400), dining out ($350), hobbies ($250), clothing ($300), miscellaneous ($200)

- Savings ($1,000): Emergency fund ($300), TFSA contribution ($500), debt reduction ($200)

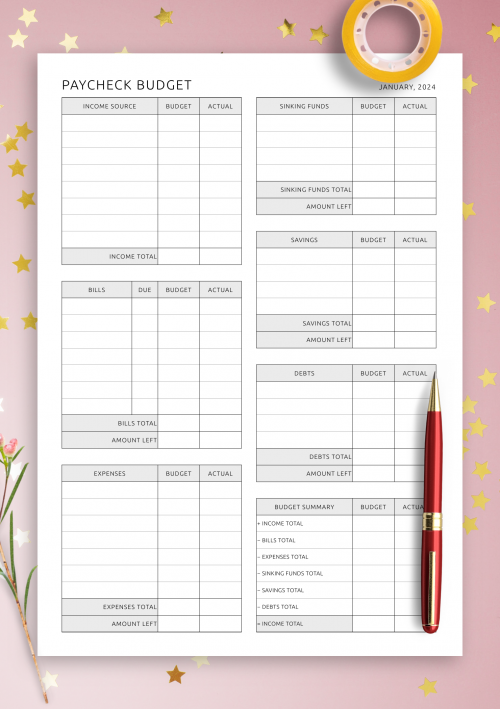

Choose Your Canadian Budgeting Method

- Zero-Based Budgeting: Every dollar has a job; especially effective for couples managing shared expenses

- Envelope System: Physical or digital allocation of funds to categories; great for controlling discretionary spending

- 50/30/20 Rule: Classic structure adapted for Canadian cost of living

- Buffer Budget: Focus on building financial buffers (emergency fund + sinking funds)

Budget Setup Tips for Success

- Start with last 3 months of actual spending for accurate baseline

- Include a "miscellaneous" category (3-5% of budget) for unexpected needs

- Use separate accounts for different savings goals

- Review and adjust categories quarterly

- Include GST/HST considerations in price estimates

- Start simple but be comprehensive

- View budgeting as empowerment, not restriction