The Canadian Family Budget Starter Pack

Complete beginner strategy for building your first family budget. Learn the 50/30/20 framework adapted for Canadian realities, from rent and groceries to emergency funds.

Read Guide →Building financial security through practical budgeting strategies tailored for Canadian households. From rent and utilities to groceries and seasonal expenses, create a budget that grows with your family.

Comprehensive strategies for building and maintaining your Canadian family budget

Complete beginner strategy for building your first family budget. Learn the 50/30/20 framework adapted for Canadian realities, from rent and groceries to emergency funds.

Read Guide →

Building financial security through Canada's unique liquidity system. Discover the three-tier approach: Stability Fund, Opportunity Fund, and Wealth Reservoir.

Read Guide →

Conquering Canada's most expensive financial seasons. Master winter heating costs, back-to-school expenses, and holiday budgeting with proven strategies.

Read Guide →Essential areas every Canadian family budget should cover

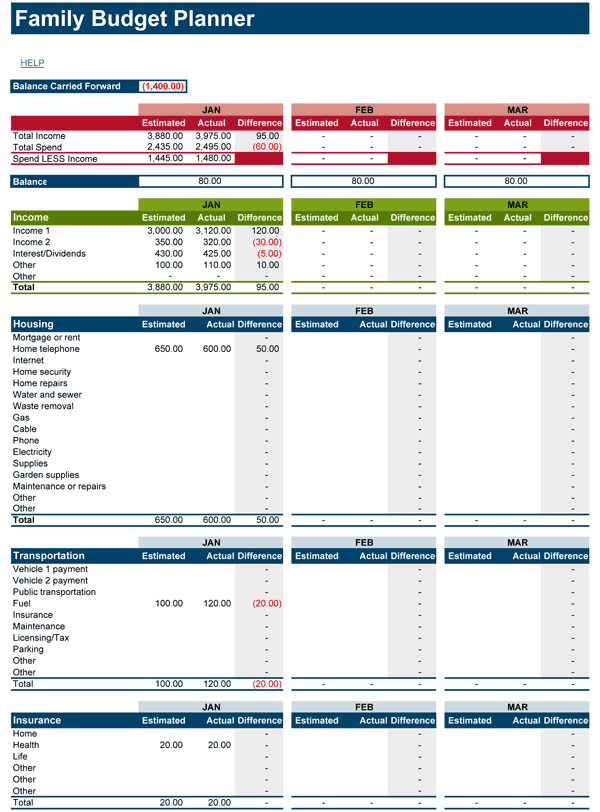

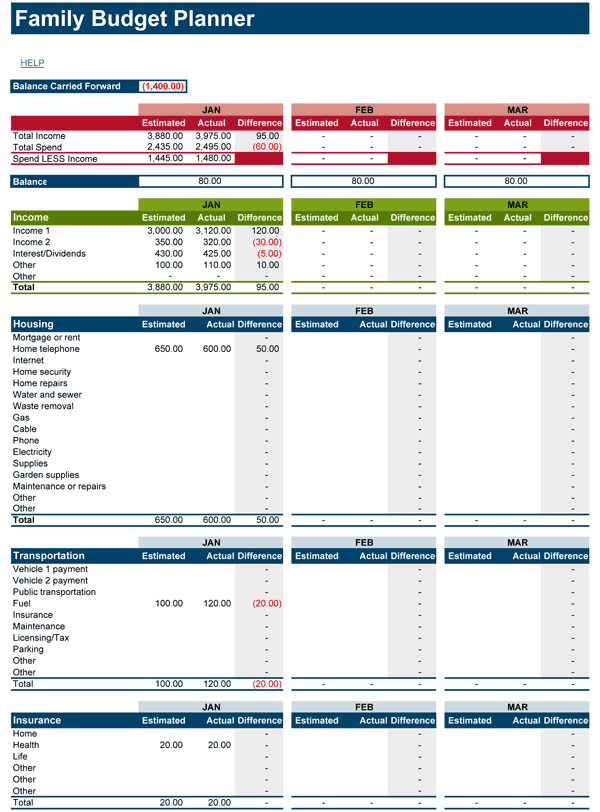

Categories, tools, and getting started with your first family budget

Rent, utilities, insurance - the foundation of your monthly expenses

Weekly meal planning and grocery budgeting strategies for Canadian families

Car ownership costs, insurance management, and transportation alternatives

Emergency funds, TFSA/RRSP strategies, and building wealth

Managing streaming services, apps, and subscription creep

Winter heating, back-to-school, and holiday expense planning

Downloadable templates and planning checklists

"BudgetNorth's seasonal planning guides saved us over $2,400 last winter alone. The sinking fund system for heating costs and holiday expenses was a game-changer for our family budget."

"The emergency fund strategy helped us build $15,000 in savings while paying down debt. The three-tier system made it manageable and gave us peace of mind."

"After implementing the grocery planning system from BudgetNorth, we reduced our weekly spending by 25% without sacrificing quality. The Canadian-focused meal prep strategies are brilliant."

Stay informed with the latest Canadian budget trends and strategies

Food prices in Canada are projected to rise 3-5% in 2025, adding $801 more to the annual grocery bill for an average family of four. Learn strategic approaches to maintain your food budget.

Read More →

New research reveals Canadian car owners spend an average of $1,370 monthly on vehicle expenses. Discover alternatives and optimization strategies to reduce transportation costs by 30-50%.

Read More →

Canadian families now spend $320 monthly on streaming, music, and digital subscriptions. Learn our audit framework that has helped families reduce spending by 40-60%.

Read More →

Traditional emergency fund guidelines may be insufficient for Canadian families. Explore the modern three-tier liquidity system that provides both protection and wealth-building opportunities.

Read More →